Over the past few months, in line with running a website which talks about the “Future of the Web” and the “Future of Retail” I’ve been spending a fair amount of time investigating cryptocurrencies.

There are already mechanisms to make online payments using crypto, which I’ve worked with and on, and many questions I personally field from clients and colleagues are of a more basic nature, like “where do I even start with crypto?!” and “wth, is this a total scam?!?!”

For this reason, I’ve been evaluating a variety of services which aim to make owning and investing in crypto and shares more readily available to those “non-nerds” among us… you know, the ordinary person!

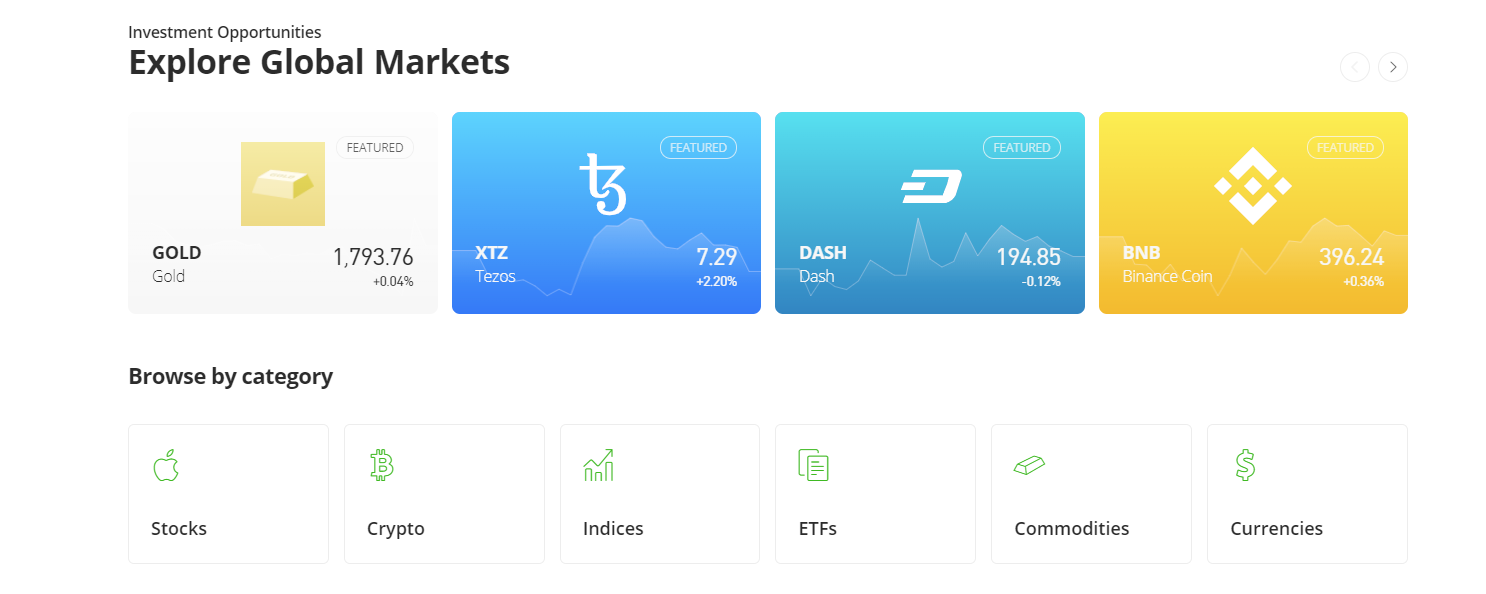

One such service is eToro, which allows commission-free share trading (buy, sell (short), CFD (leverage trading – Contract For Difference)) and also commission-free crypto-currency trading on a limited range of crypto assets – mostly the most popular, such as Cardano (ADA), Bitcoin (BTC), Etherium (ETH), Litecoin (LTC) and etc.

Specifically, for the non-technical, eToro offers a simpler entry point to owning crypto assets, because you don’t need to setup a “wallet” to hold each “coin”. All you need is an account, and you can exchange money (USD) for crypto coins, at (close to) the current price. You can later close this trade for profit assuming the price goes up.

Disclosure: I am a holder of many crypto assets, as well as many stocks, shares and indeces. Assume I hold anything and everything mentioned in this post — and more! I’m also a customer, and affiliate of eToro, and will be paid if you use my referral links to sign up with eToro.

Speaking of which… the first 10 friends who sign up with eToro in the UK (you must be in UK or Singapore) using the following link, who deposit at least $200 and invest at least $100 in a single trade will receive $50 — and I will receive $50. If that sounds interesting:

Click here to use my referral link and get $50 to trade on eToro.

Below I will be storing – and adding to – a list of FAQs which may help you get started trading crypto or shares, specifically on the eToro platform.

Good luck with your investments!

This is not financial advice. Just my opinion. Like all people, my opinion isn’t 100% reliable.

Table of Contents

Frequently Asked Questions about eToro

Can I Get Staking Rewards on eToro?

Yes – you can – if you invest in ADA, TRX or – in future – ETH, you’ll be able to claim monthly rewards for your holding. The rewards increase based on your eToro club status, and also you’ll only receive them after 9 days of holding.

What is a Copy Portfolio?

A copy portfolio on eToro is where you “copy” another investor and follow their trades, risking a certain amount of money. The proportion of the trade is set by the original investor, allowing you to invest “hands free”. The person you copy is rewarded with a very small percentage fee for this process.

Can I Get Staking Rewards via Copy Portfolios eToro?

The answer is no. Not currently. You don’t receive staking rewards if you are copying another crypto investor, even if you copy their holding of qualifying crypto assets.

What are does PoS, PoW and Staking mean?

Some cryptocurrencies are Proof of Stake (PoS) instead of Proof of Work (PoW). Proof of Stake means that you can “stake” some of your coins and receive rewards – a little like a bank pays interest – in return for validating transactions. These coins include Cardanoo (ADA), and Tron (TRX). From 2022, Etherium (ETH) is moving to a PoS model, from a PoW model (PoW means coins are “mined” and transactions validated by carrying out complex equations using – a lot of – compute power).

Do I need to provide ID?

Yes, you’ll need to provide your identity to sign-up an account with eToro. Actually, this is a fairly lengthy process – and expect more regulation here too.

Is there a minimum investment?

Yes – the minimum amount of shares or any crypto asset you may buy or sell in a single transaction is the equivalent of $25 USD. “Wait, how is this, thats lower than the price of a lot of shares – or the price of one Bitcoin?!” You’re wondering! Well, you can buy a part of a share, or a part of a crypto asset.

Can I earn dividends from shares on eToro?

Yes, you can, even from part shares you own, you’ll receive dividends, as long as you own them before the opening of trading on the ex dividend date! This does not include copy portfolios, unfortunately, at present, which as a dividend investor, I do find a little frustrating.

Wait, what’s an ex dividend date?

The Ex Dividend Date is the date on which registered shareholders will be paid out the declared dividend. There will be a “declaration date” (the date on which the dividend is declared) and a “payment date” – the date on which the dividend will be paid to all those who held shares on this “ex dividend date”. In order to be paid, buy shares before the close of trading on the business day before the ex dividend date.

What about “green crypto”?

PoW coins require a lot of compute power to mine and authenticate transactions. BTC, for example, uses a lot of power, and in fact is apparently using as much electricity as the whole of the Netherlands, according to some estimates. PoS coins use way, way less power to validate transactions. ADA and TRX are PoS coins, while ETH will be from 2022. For this reason, they are regarded as “greener” options.

What are the fees like on eToro?

There aren’t any direct fees – commission fees – on your trading activity, nor are there any fees when you deposit funds into your eToro account, however, eToro is a profit making business. They make money from a variety of channels – but specifically, the following could be regarded as fees:

1) Spread – the difference between the buy and the sell price offered on the platform;

2) Withdrawal fees – they charge a flat fee when you take your money out (around $5 USD) – but members on higher club tiers can avoid this (you need to have a lot of funds invested to get here!).

3) Currency conversion fees – charged when you deposit and withdraw into USD.