A quick post to make a recommendation of a banking product for business which is not truly horrible.

Several months ago, at Silicon Dales, I learned a little, along with my colleagues about PSD2, which is new European banking legislation designed to shakeup banking, and remove what have essentially been penalty charges for things like paying with a credit card (among many other things).

A few years ago, I listed out the feature I wanted in a modern bank, while waiting more in hope than expectation for one of the major players in the UK and European banking markets to pull out their fingers and do something.

This list included things like:

- An end to free banking – pay a fee for the account (I know, right, pay for the service… because if its free, you’re the product 😉 )

- No commission on money transfers

- Ability to quickly (instantly) move money from one currency to another

- No commission on “cross border” payments

- No additional charges and commission for using a payment card in another currency

As we deal internationally, both on the “buy” and “sell” side at Silicon Dales, and indeed make payments to contractors, shareholders and employees who are based in other countries – a situation for a relatively small business which will soon become the norm – the above wishlist starts to become important.

For example, if you’re paying server bills in 4 or 5 figures in USD from a GBP account which carries a percentage fee as well as a commission for this, you will find your costs soon add up… for no additional benefit.

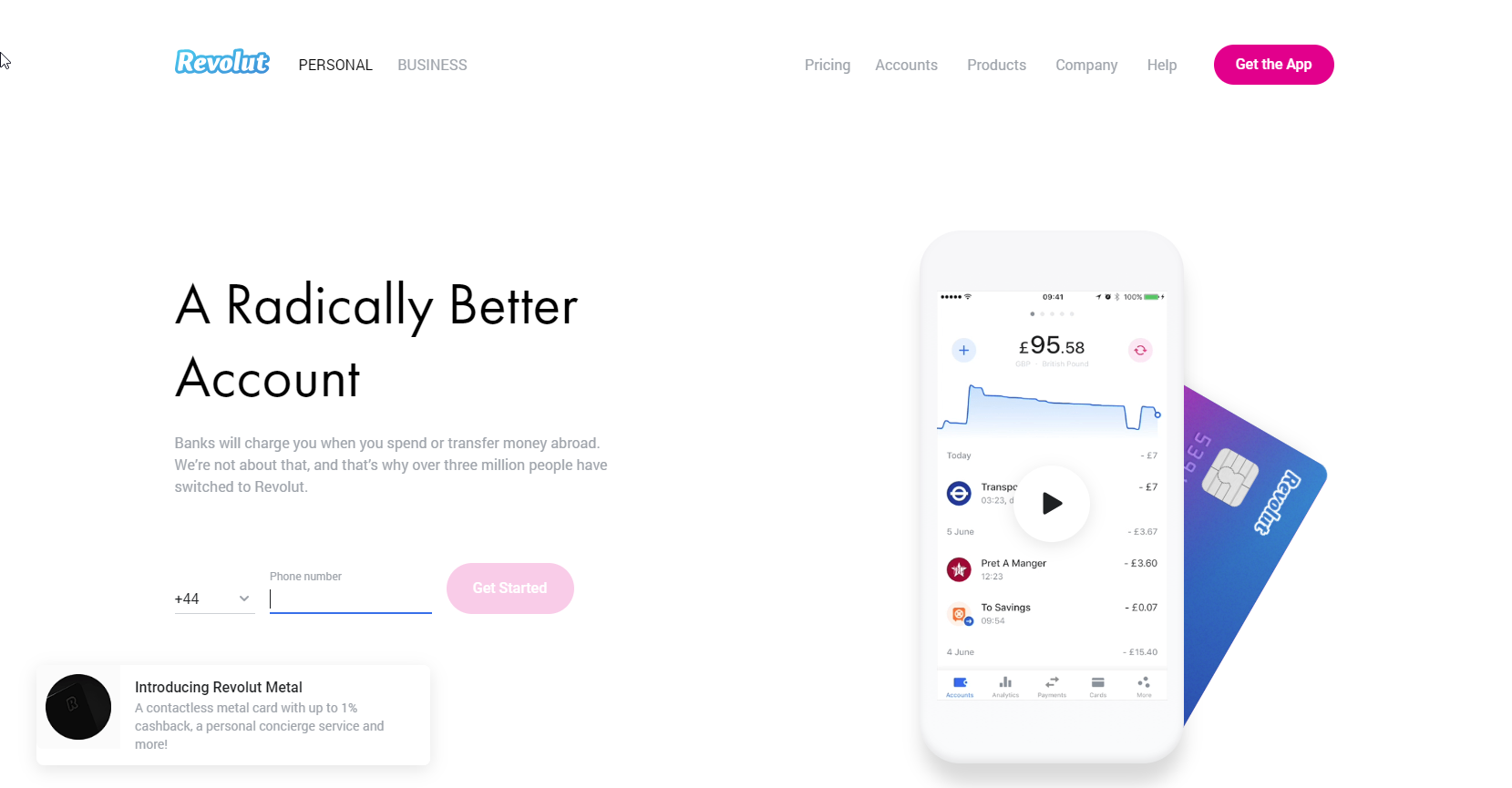

So for this reason, we hunted and hunted. And finally we found it. An account called “Revolut” – full disclosure this is my business “referral link”. Using this link will benefit my business, but it won’t add any additional cost. I don’t know if you will receive a direct benefit from using it, but you might!

For our part. We will be opening and using a modern account with Revolut and, if all goes as well as it has to date, we will be moving some important elements to this account from more traditional, expensive, and perhaps no longer fit for purpose “old fashioned” banks, which don’t meet our modern criteria. I suggest you at least evaluate options for doing the same.

In terms of dollars and cents: in one month, our banking charges exceed a year’s worth of expected fees on Revolut. While transferring any payment system is not pain free, I can tell you, it is already well worth the effort expended, because the cost savings are significant.

Also, payments are instant, and the technology looks solid, too. So far, so good.

- Click here to visit Revolut and explore your options for opening a business account.

UPDATE – please note fee-free business banking is now available – see the link above. Also, this is my personal referral link, and Revolut may pay me a commission for this referral. I’m honest about this, because I like people to be open about their affiliations. The advice above is based on me personally using and recommending this product.