UPDATED July 2022

I’m regularly in touch with a coterie of around 250 specialist developers over at Codeable and a common pinch-point for their freelancing activities outside the platform is finding an easy way to invoice clients and keep track of payments. Indeed, it’s why Codeable is preferable for many.

With recent Making Tax Digital requirements for Limited companies (and others) who have registered for UK VAT, you may find HMRC is insisting on you using “third party software” to report your VAT. A key advantage of FreeAgent is that it can track and submit your VAT (and company, and personal) accounts, directly, into HMRC, having reconciled the original payment directly from your bank.

Click here to visit Freeagent and signup online – with a 10% discount.

Table of Contents

Invoicing can be Painful for Freelance Developers

Managing invoice numbers, inbound payments, accounts owing and etc can be a real headache if you are also the chief, the indian, and basically… well everything is your job.

Invoicing is necessary for most tax filing, and allows you to keep track of client payments (even payments from freelancing platforms) – as well as to accurately account for expenses too.

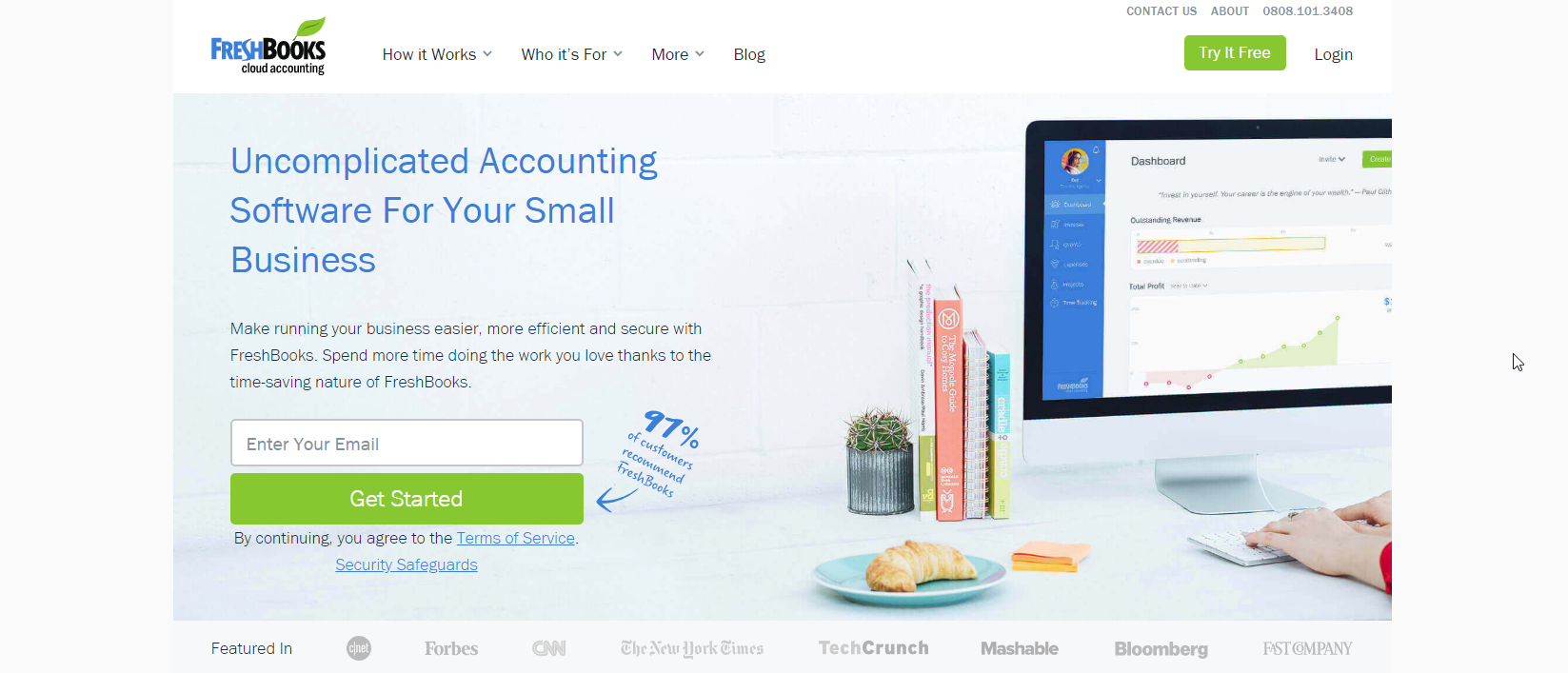

I recommend Freshbooks

For this, I like Freshbooks <- this is my referral link which will get you a free month (and me a free month!! woohoo!) if you use it and signup a new account. 1 month should be enough to assess the platform.

For those who also deal direct, invoicing and payments can create a pinchpoint, and that’s where Freshbooks comes in. It can handle recurring payments and works with all the major payment gateways including Stripe, Braintree and PayPal.

Main Benefits of Freshbooks

- Email customers and clients your invoices – and see when they open them;

- Email is deliverable (i.e. it reaches them often and doesn’t sit in spam filters);

- Online payment is possible through Stripe, Braintree and PayPal (or Freshbooks own systems) – you can give your customer the options, too, of all three to choose their favourite!

- Keep track of payments – mark them received easily in the system;

- Easy to setup recurring billing profiles (including recurring CC payments which are automatic) – note CC payments carry additional fees for recurring profiles.

- “Snail Mail” in the USA… they will actually mail your invoices to US customers. Like in the olden days.

Click here to visit Freshbooks and get started.

Accounts for Freelancers – FreeAgent

I am probably going to write it up further, and in more depth, but the software I also rate for freelancing, and running a Ltd Company too (or Partnership, or as a Sole Practicioner – see, all those years studying company law and Tax Law at University weren’t wasted 🙂 ) is FreeAgent.

FreeAgent provides similar (not the same) invoicing to Freshbooks. It’s not quite as good – you don’t see if client has opened; and also, the mail didn’t seem to be as deliverable; lastly, recurring payment profiles were not possible, nor as good. There were other minor things which meant using both Freshbooks and FreeAgent were preferable, but you get the idea.

But the other features of FreeAgent are incredible:

Main Benefits of Freeagent

- Direct feeds from your bank account(s) (all of them!)

- Direct feeds from your Credit Cards

- Expenses all trackable from the system

- Payroll and Salaries handled (including PAYE filing direct from the software)

- Companies House and HMRC filing from the software

- VAT tracking and filing direct from the software (huge win – including VAT on expenses – no more receipts in envelopes and face-palming, use the app, take a pic, and put the VAT in as you go!)

- Personal Self Assessment filing from the software.

In short, you won’t need any other accounts software. You might not even need an accountant (maybe!) – but, if you do pay one, and you should, then that person can be given access and do it all from the FreeAgent software.

A huge endorsement from me.

Click here to find out more about FreeAgent and sign up.

Using Freshbooks + FreeAgent

Freshbooks + FreeAgent is a great package. Handle client payments in three currencies (Freshbooks), and accounts for a Ltd Company registered in England + Wales (FreeAgent).

Do payroll for staff, and make payments out to many contractors, and all these expenses are correctly categorized and accounted for.

An accountant can login and give the books a once-over, ask us simple questions, and then file in moments, using our official HMRC login information, without ever leaving the FreeAgent platform.

If you had to pick only one, I would pick FreeAgent in a heartbeat. It probably saves 100s of hours, running a business, and countless moments when I would have lost the will to live using HMRC’s filing software (horror of horrors!).

Why to use my FreeAgent link?

My FreeAgent link will get you 10% off (and me 10% off), and this is a beneficial thing. There’s also a 30 day free trial, during which you don’t need to actually put your payment information in – so actually free, free.

Click here to find out more about FreeAgent and sign up. You get a 10% discount with this link – and so do I. Massive win.